May 2020 Market Update

1. Stock prices have risen due to inflation expectations, not the prospect of a swift recovery.

After an initial liquidity crunch that led to a nearly 35% drawdown of the S&P 500, the index rallied strongly and is now only down ~15% from it's all time high. Amazingly, the NASDAQ is nearly at the level it was at the beginning of 2020. My aggressive portfolio concentrated in just 4 assets (Bitcoin, Ethereum, Tesla, and Square) is now down only 3% from its all time high in February!

Why is this? As many have observed, the Fed ended the liquidity crunch on March 23rd by signaling its commitment to create an unlimited amount of money to prevent business failure.

Since March 2020, the Fed has created more money than in the entire decade from 2010 to 2020, which itself saw a massive expansion in the supply of money from two “quantitative easing” programs.

As Ray Dalio has written before, equities with strong balance sheets and cash flows far in the future make for excellent inflation-hedge assets. Tesla is one such stock with a strong balance sheet and the majority of cash flows 10 years or more in the future.

2. From my employer, PrecisionLender: Middle Market Loan Volume Has Crashed

“The small business lending market has effectively been nationalized for the time being.”

“The middle market is effectively not functioning at all right now.”

3. My bet is that the US economy will undergo a “swoosh-shaped” recovery that lasts 2 to 5 years.

4. Google search interest for the 2020 Bitcoin halving was over 10x the 2016 halving.

5. Paul Tudor Jones, a hedge fund manager with an estimated net worth of ~$5 billion, allocated nearly 2% of his portfolio to Bitcoin to protect himself from what he calls the Great Monetary Inflation.

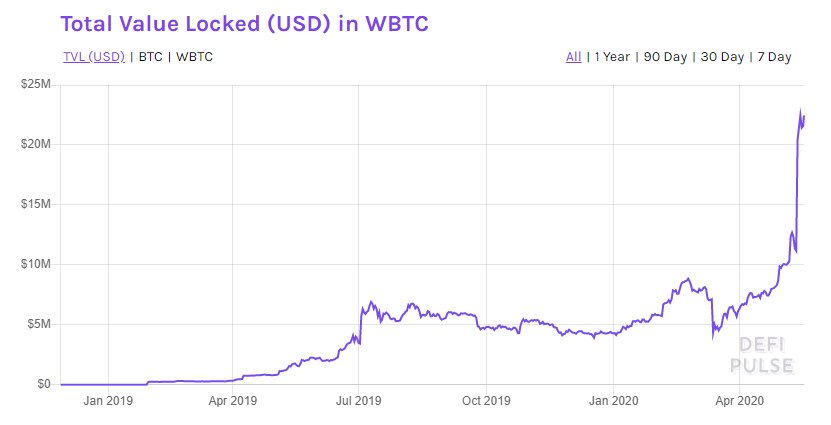

6. Cross-chain interoperability is allowing Bitcoin to exploit its monetary network effect on Ethereum.

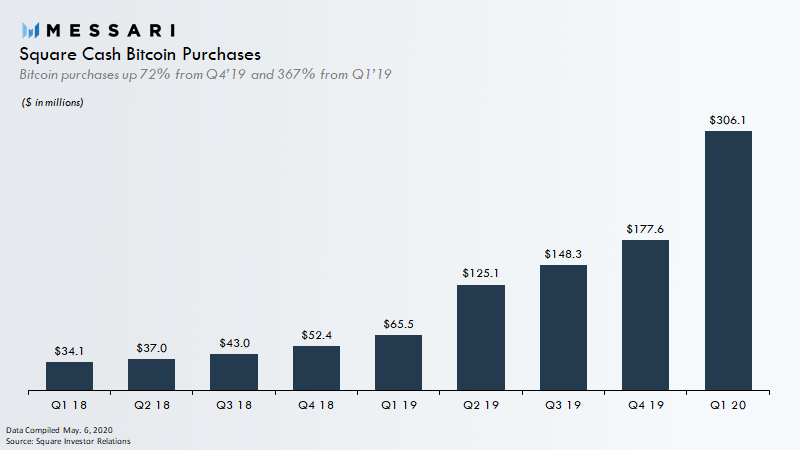

7. “Cryptodollar” is more descriptive than “stablecoin”.

8. “EIP 1559 is the final piece of the puzzle in Ethereum’s monetary policy.”

Ethereum’s monetary policy has always puzzled to me. Unlike Bitcoin, it does not have a credible commitment to a fixed supply, and its liquidity is less than one-quarter that of Bitcoin’s. This makes it less suitable than Bitcoin for the role of global reserve currency.

EIP-1559 enables Ethereum to capture and accrue value, even in a world where Bitcoin becomes the global reserve currency and the “King of Collateral” on the Ethereum network.

EIP-1559 would “burn” the majority of ether in the transaction fee of each block, reducing the supply of ether as the demand for computation on the Ethereum network increases; this should cause the price of ether in USD terms to rise with the success of the Ethereum network.

9. Value transfer on Ethereum has reached parity with Bitcoin.

I believe value transfer on Ethereum will quickly explode past Bitcoin as the issuance of cryptodollars on Ethereum continues to soar. More tethers have been issued since the beginning of 2020 than from 2018 to 2020 - wow!

10. Augur’s V2 release is scheduled for June 2020.

The value locked in Augur has declined nearly 90% from its peak during the November 2018 midterm elections.

I have remained bullish because the greatest risk Augur faces is execution risk, not market risk.

Augur was the first ICO on Ethereum and has the potential to fill an oceanic (>$1 trillion annualized) market.

New cryptographic primitives will decrease the cost to create and trade prediction markets on the Augur protocol. I believe that Augur will ultimately surpass its centralized peers (PredictIt, BetFair, etc.) and expand the size of prediction markets more than 100x!

11. Mr. Wonderful finally understands Tesla is a data and autonomy play, not an electric car play.

“I was a hater of Tesla for a long time, until I realized all the engineers want to work for Tesla. I ended up buying some, and now it's my best performing stock. It's not a car company, it's a data company. It's about autonomous driving.” [video]

12. Cash App is expanding its lead over Venmo.

13. Retail buyers are gobbling up Bitcoin on Cash App at an increasing pace.

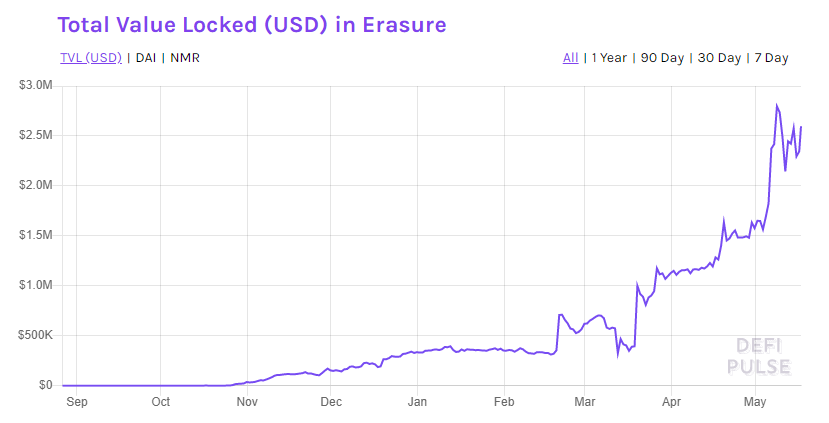

14. The price of my “favorite coin”, Numeraire, has surged from $6.50 on January 1st to $29 with the initial success of the Erasure protocol.