Why does nobody own Gold?

Since President Richard Nixon took the United States off the last remnants of the Gold Standard in 1971, gold has actually outperformed the S&P 500 index in nominal terms.

In the 50 years ended January 2020, the price of an ounce of gold in nominal dollar terms has grown at a 7.7% compound annual rate whereas the S&P 500 index has grown at a 7.6% annual rate over the same time period.

Why does nobody know this?

Here’s how the nominal annual growth rates compare by decade since 1970:

Gold dramatically outperformed in the 1970s and 2000s whereas the S&P 500 outperformed gold in the 1980s, 1990s, and 2010s in nominal US Dollar terms.

The two asset classes are strongly inversely correlated by decade; gold tends to outperform when stocks fare poorly and vice-versa. This provides strong evidence that gold delivers diversification value to a portfolio of stocks.

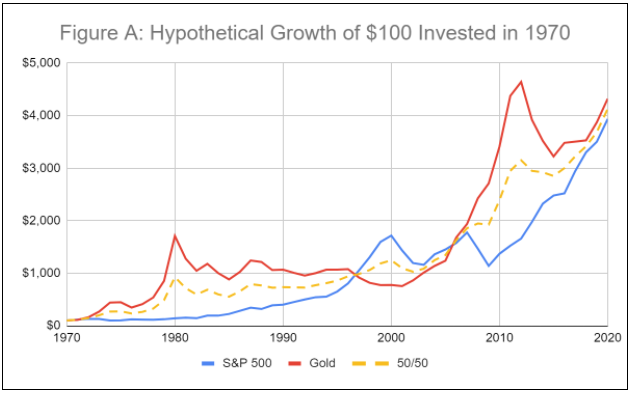

This can be seen visually in the growth of $100 invested in 1970 in each of the asset classes compared alongside a portfolio of 50% gold and 50% stocks:

Since 1970, a portfolio of 50% stocks and 50% gold had significantly less volatility than either a portfolio of 100% stocks or 100% gold. The mixed portfolio deftly avoids the Dot-com Bubble and the Housing Crash in the 2000s, but actually declines during the bull market of the 1980s, with a 24% drawdown from 1980 to 1990.

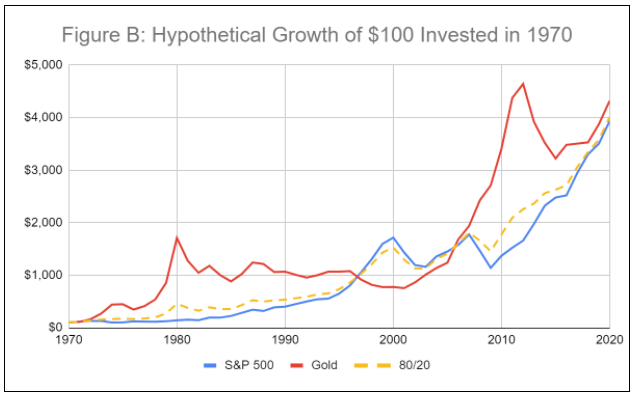

A portfolio of 80% stocks and 20% gold has more volatility, but fewer nominal declines between decades - not a single decade sees a nominal portfolio drawdown. This compares favorably to the 40% drawdown for gold from 1980 to 1990 and the 23% drawdown for stocks from 2000 to 2010.

If gold provides significant value as a portfolio diversifier, reducing volatility without decreasing total returns, why do most investors have a 0% position in gold?

I can think of several possibilities:

Confounding Economic Paradigms: The nominal annual return on gold in the Gold Standard Era (1776 - 1971) was approximately 0%. During this time period, dollars were redeemable for a fixed quantity of gold by the U.S. government; gold redeemability was severed for U.S. citizens in 1933 and for foreign nations in 1971. Most calculations of gold’s performance overlap the period of the Gold Standard with the current regime of floating fiat currencies (1971 - Present). This calculation confounds two different economic paradigms (low vs. high inflation) with different return profiles for gold as an asset class. The nominal annual return for gold drops to 2.0% when starting from the year 1800 instead of 1971.

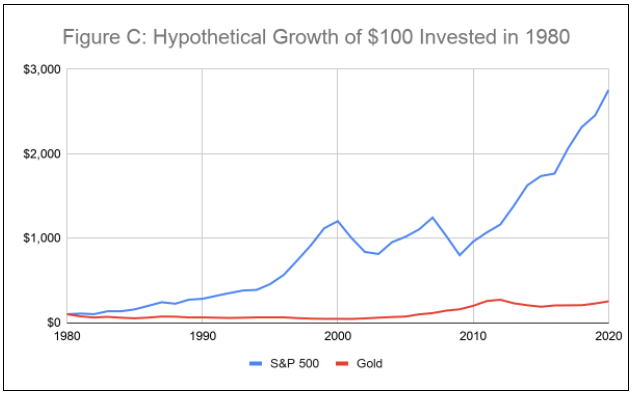

Generational Recency Bias: The vast majority of gold’s outperformance took place in two decades, the 1970s and the 2000s. Baby Boomers own over 50% of total U.S. wealth and most of them came of age during the 1980s when stocks dramatically outperformed gold as an investment. If you shift the time scales of our calculations by only a decade, gold grows at a meager 2.1% compound annual growth rate compared to an astounding 8.8% for the S&P 500 since 1980!

1970s Historical Anomaly: The 1970s account for the vast majority of gold’s performance over the past 50 years. The price of an ounce of gold surged 18x from the beginning to the end of the decade while stocks lost 37% of their value when adjusting for inflation.

Perhaps most investors believe that the decade of the 1970s was a unique economic era as capital flowed into gold following the end of the Gold Standard and restrictions on private gold ownership in the United States were eliminated.

Still, it’s confusing that most investors would not have any position in gold given its comparatively recent outperformance vs. stocks in the 2000s. Since the year 2000, gold has grown at an 8.8% compound annual growth rate compared to 4.4% for the S&P 500.

Costly Custody: Perhaps custody is a requirement for gold to be a sound investment and this is prohibitively costly for most individuals. The U.S. government confiscated gold in the 1930s and did not allow individuals to own gold again until 1974. It’s possible that the government might confiscate gold again in the future, and therefore there is some seizure risk associated with owning gold stored by a third party in a bank or an ETF.

Moneyless Millennials: The late 2000s Housing Crash, the Great Recession, and subsequent bear market in stocks were formative experiences for many Millenials. These generational experiences should make them more predisposed to own gold than Boomers, and indeed, Millennials are the only generation that believes cash is a better long-term investment than stocks. However, they only own 3% of total US wealth and many prefer Bitcoin or other cryptocurrencies over gold.

What do you think? Why is gold not a more popular investment?

References:

Gold and S&P 500 index price data over time was obtained from Macrotrends and used for all tables, graphs, and return calculations in this post.